05: Innovation SLC

05: Innovation SLC

We now move on to the product development module. As you study today’s readings note how they complement and reinforce our prior readings by Peter Drucker and Bill Davidow.

- In The New Venture, Drucker emphasizes the importance of a market-driven focus where the customer defines the product through a feedback process.

- In The Winning Strategy, which we discussed in the last class, Davidow reminds us that “engineers create devices but customers buy products” and the importance of focusing our early sales effort with efficient market segmentation. Moreover, you’ll see the importance of looking at the fish throughout these readings.

Read “Innovation: A Customer-Driven Approach” (HBS#9-695-016). This reading is rich in content and is worth a careful study. Think about how you would answer the following study questions during your analysis of this reading:

- How should we assess the market potential for a new high-tech first of its kind product? Describe each step in the process.

- What/who are “stakeholders” and what role do they play in the process of shaping an idea into a product?

- How do “concepts” differ from “ideas” and how do concepts evolve from ideas?

- How do “products” differ from concepts and how do products evolve from concepts?

- What purpose(s) do prototypes serve in the product development process?

Next, read “Sales Learning Curve” (HBR#1003). Think through the following study questions as you read this article:

- The article emphasizes that a large sales force hinders more than helps a company launch a new product. Explain?

- What is a “sales learning curve?” How is it different from a “manufacturing learning curve?”

- Describe the three phases of the sales learning curve.

- How does the interaction with your customers differ in the “initiation phase” from the subsequent “transition” and “execution” phases? What personal qualities do your salespeople need in this initial phase as compared to the subsequent phases?

- Describe the dangers of a premature marketing campaign.

- The article discusses interactions between a company’s sales force, marketing department, engineering department and senior management. How does this translate to a start-up company where the entrepreneurial team is unlikely to be so departmentalized? (It is often said that an entrepreneur’s primary job function is selling.)

- How are the sales learning curve and innovation funnel (from the reading above) related? How are they different?

Watch the "Sales & Marketing $0-1 Million" talk available at https://youtu.be/SHAh6WKBgiE

This 20 minute talk, given by Clever (https://clever.com/) founder/CEO Tyler Bosmeny, is likely the best tutorial you'll find anywhere on sales at the hardest/earliest stage of a company's life. It was given during a one-time course taught at Stanford in the Fall of 2014 (CS183b, "How to Start a Startup") run by Y Combinator and released into the Creative Commons (https://www.startupschool.org/). This video is relevant to the “Sales Learning Curve” article and venture development. As you watch the video, consider the following:

- At the earliest days of a startup, who is the salesperson?

- What is a sales funnel?

- When you're an early-stage tech company full of risk, who are your customers along the Diffusion of Innovation curve and what are the implications for your sales efforts/approach?

- How do you effectively reach prospective customers?

- What is the key characteristic of a successful sales conversation?

- How should your sales approach change over time to become a $100 million company (in annual sales) depending on the deal size of each sale?

Review the “Palm Computing, Inc. (A)” case (HBS #9-396-245) originally assigned for the previous class. This case discusses key issues of intellectual property surrounding the launching of Palm Computing, Inc., Jeff Hawkins’ early venture in palm-sized, pen-based personal computers. Consider the following:

- Based on the principles of the “Innovation: A Customer-Driven Approach” reading, how would you recommend that Hawkins proceed with the design of a palm-sized pen-based personal computer.

- Based on the principles of the “Sales Learning Curve” article below, how would you recommend Hawkins approach sales for the Palm.

Innovation: A Customer-Driven Approach

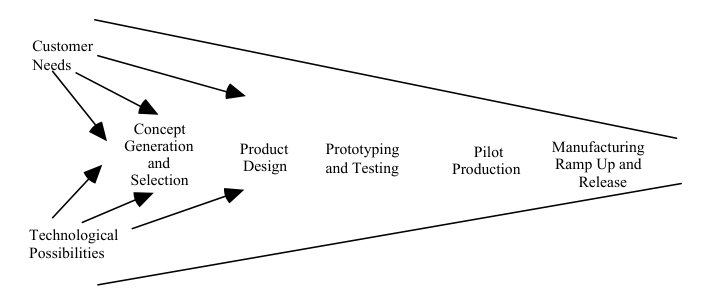

Innovation Funnel

1. Assessing Market Potential for a New High-Tech First-of-its-Kind Product

How should we assess the market potential for a new high-tech first of its kind product? Describe each step in the process.

Steps in the Process:

- Population-Based Estimates: Calculate potential demand using demographic data and usage patterns (e.g., household adoption rates for durable goods).

- Population * Usage-Based Estimates: Calculate potential demand using demographic data multiplied by usage patterns (e.g., household adoption rates for durable goods).

- Forecast by Analogy: Compare the product to similar innovations in related markets (e.g., using early adoption rates of cable TV to estimate demand for a new streaming service).

- percentage of complementary product sales

- based on past competitor performance:

- Complementary Product Analysis: Link demand to sales of related products (e.g., estimating software sales based on projected notebook computer purchases).

- Scenario Planning: Develop best-case, expected, and worst-case scenarios using competitor performance data and historical success rates in the industry.

- Validate Assumptions: Challenge forecasts through stakeholder interviews, expert reviews, and iterative market testing.

- Plan for Contingencies: Design flexible development and manufacturing processes to adapt to demand fluctuations (e.g., modular production systems).

Key Takeaway: Use a mix of quantitative and qualitative methods, but remain skeptical of over-optimism. Prioritize agility to respond to real-world feedback post-launch.

2. Stakeholders and Their Role

What/who are “stakeholders” and what role do they play in the process of shaping an idea into a product?

Who Are Stakeholders?

We refer to all groups with a stake in the development, existence, and obsolescence of a product as "stakeholders."

Stakeholders are all groups impacted by the product’s lifecycle, including:

- Internal: Designers, engineers, manufacturing, and service teams.

- External: Customers, distributors, regulators, end-users, and even maintenance or disposal teams.

Role in Shaping the Product:

- Provide diverse perspectives on needs (e.g., hospital administrators focus on cost, while nurses prioritize usability).

- Highlight conflicting requirements, forcing trade-offs (e.g., durability vs. weight in a hiking tent).

- Ensure the product aligns with real-world use cases (e.g., noise levels in hospital environments affecting alarm design).

Key Takeaway: Stakeholder input ensures holistic design but requires prioritization (e.g., using the Kano Method to classify "must-haves" vs. "delighters").

3. Concepts vs. Ideas

How do “concepts” differ from “ideas” and how do concepts evolve from ideas?

Differences:

- Ideas: Initial, unstructured thoughts (e.g., "a device to manage household communication").

- Concepts: Detailed plans with a positioning statement (differentiation + segmentation) and specifications (e.g., "The Butler" home communicator with base stations and client-server architecture).

Evolution from Ideas:

- Translate stakeholder needs into metrics (e.g., "easy to use" becomes a usability score).

- Use brainstorming and cross-functional collaboration to integrate technical feasibility.

- Refine through iterative feedback loops (e.g., prototyping and stakeholder reviews).

4. Products vs. Concepts

How do “products” differ from concepts and how do products evolve from concepts?

Differences:

- Concepts: Blueprints describing what the product should achieve (e.g., performance targets, user experience).

- Products: Tangible outputs developed through engineering, design, and testing (e.g., the iPhone’s final hardware/software integration).

Evolution from Concepts:

- Engineering and Design: Translate abstract requirements into technical specifications (e.g., material selection, software architecture).

- Prototyping: Validate feasibility and gather feedback (e.g., testing motor noise in a blender).

- Pilot Production: Refine manufacturing processes (e.g., ensuring supplier readiness).

- Market Launch: Execute integrated marketing, distribution, and sales strategies.

5. Purpose of Prototypes

What purpose(s) do prototypes serve in the product development process?

- Test Feasibility: Verify technical performance (e.g., ensuring components fit or meet safety standards).

- Gather Feedback: Collect customer/stakeholder feedback on part or all of the concept Assess usability and stakeholder satisfaction (e.g., ergonomic testing of a handheld device).

- Communicate Vision: Demonstrate ideas to investors, teams, or partners (e.g., using a model to secure funding).

Key Takeaway: Prototypes vary in fidelity (from rough mockups to near-final models) but are critical for aligning the team and avoiding costly late-stage revisions.

Sales Learning Curve

1. Why a Large Sales Force Hinders New Product Launches

The article emphasizes that a large sales force hinders more than helps a company launch a new product. Explain?

A large sales force too early leads to inefficiency and cash burn because:

- Unrefined Product: Early-stage products often lack critical features or have usability issues (e.g., Scalix’s Linux email system needed iterative improvements post-beta).

- Misaligned Sales Strategy: Without understanding customer needs, sales teams target the wrong decision-makers (e.g., Scalix initially focused on CIOs instead of IT managers).

- High Costs, Low Revenue: Sales reps cost more than their revenue contribution during the learning phase. Hiring too many too soon worsens cash flow (e.g., Veritas’ failed bundled software due to premature scaling).

Key Takeaway: Early sales efforts should focus on learning, not scaling.

2. Sales Learning Curve vs. Manufacturing Learning Curve

What is a “sales learning curve?” How is it different from a “manufacturing learning curve?”

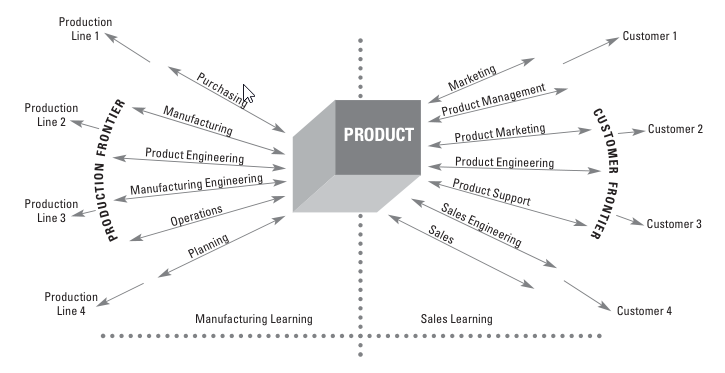

- Manufacturing Learning Curve: Focuses on reducing unit costs through efficiency gains as production volume increases.

- Sales Learning Curve: Measures sales yield (revenue per sales rep) and improves through organizational learning about customer needs, product-market fit, and sales processes. Involves cross-functional collaboration (marketing, engineering, sales).

Example: While manufacturing a smartphone becomes cheaper over time, selling it requires learning which features resonate with customers and refining the sales pitch.

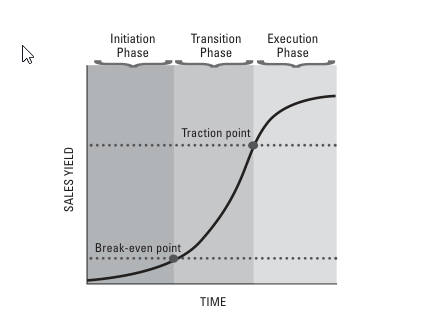

3. Three Phases of the Sales Learning Curve

Describe the three phases of the sales learning curve.

Initiation Phase:

- Goal: Learn from early customers to refine product and strategy.

- Sales Force: Small team (3–4 “renaissance reps”) focused on feedback and cross-department collaboration.

- Metrics: Below break-even revenue.

Transition Phase:

- Goal: Develop a repeatable sales model and scale cautiously.

- Sales Force: Add “enlightened reps” comfortable with evolving processes.

- Metrics: Sales yield reaches break-even (revenue = cost per rep).

Execution Phase:

- Goal: Rapidly scale with standardized processes.

- Sales Force: Hire traditional “coin-operated reps” with clear targets.

- Metrics: Sales yield doubles break-even (“traction point”).

4. Customer Interaction & Salesperson Qualities Across Phases

How does the interaction with your customers differ in the “initiation phase” from the subsequent “transition” and “execution” phases? What personal qualities do your salespeople need in this initial phase as compared to the subsequent phases?

- Initiation:

- Interaction: Deep engagement with early adopters to gather feedback.

- Salesperson Traits: Adaptability, cross-functional communication, technical curiosity, tolerance for ambiguity.

- Transition/Execution:

- Interaction: Focus on closing deals using established scripts and collateral.

- Salesperson Traits: Process adherence, quota-driven mindset.

Example: Scalix’s early reps engaged Linux evangelists to refine messaging, while later reps targeted pre-qualified leads.

5. Dangers of Premature Marketing Campaigns

Describe the dangers of a premature marketing campaign.

- Wasted Resources: High costs without aligned messaging (e.g., Scalix saved funds by delaying broad marketing until product iteration).

- Misaligned Expectations: Confuses customers and internal teams (e.g., Veritas’ sales reps lost faith due to unfulfilled product promises).

- Opportunity Cost: Distracts from critical learning activities like refining the value proposition.

6. Sales Learning Curve in Startups (No Departments)

The article discusses interactions between a company’s sales force, marketing department, engineering department and senior management. How does this translate to a start-up company where the entrepreneurial team is unlikely to be so departmentalized? (It is often said that an entrepreneur’s primary job function is selling.)

- Entrepreneur’s Role: Acts as the “renaissance rep,” integrating sales, marketing, and engineering feedback.

- Cross-Functionality: Small teams must collaborate closely to replicate learning phases (e.g., founders directly engage early customers to iterate).

- Flexibility: Startups can pivot faster but risk burnout without structured learning.

Example: A startup founder might handle customer interviews, tweak prototypes, and adjust pricing simultaneously.

7. Sales Learning Curve vs. Innovation Funnel

How are the sales learning curve and innovation funnel (from the reading above) related? How are they different?

Relationship: The sales learning curve begins where the innovation funnel ends. While the funnel ensures a viable product, the sales curve ensures viable market entry.

- Innovation Funnel:

- Scope: Ideation to product launch.

- Focus: Concept generation, prototyping, and technical validation.

- Sales Learning Curve:

- Scope: Post-development commercialization.

- Focus: Market validation, sales strategy refinement, scaling.

Example: The innovation funnel produces the iPhone’s design; the sales learning curve refines Apple’s go-to-market strategy (e.g., targeting early adopters before mass campaigns).

Key Insight: Both frameworks emphasize iterative learning but address different stages of bringing innovation to market.

Sales & Marketing $0-1 Million

- When you're an early-stage tech company full of risk, who are your customers along the Diffusion of Innovation curve and what are the implications for your sales efforts/approach?

- How do you effectively reach prospective customers?

- What is the key characteristic of a successful sales conversation?

- How should your sales approach change over time to become a $100 million company (in annual sales) depending on the deal size of each sale?

1. At the earliest days of a startup, who is the salesperson?

At the earliest days of a startup, who is the salesperson?

In the earliest stages of a startup, the founders themselves are the salespeople. They must personally engage with potential customers to validate the product, refine the value proposition, and close initial deals. Founders have the deepest understanding of the product and the vision, making them uniquely positioned to communicate its benefits and gather critical feedback. Hiring dedicated sales teams at this stage is impractical due to limited resources and the need for agility.

2. What is a sales funnel?

What is a sales funnel?

A sales funnel how to move your customers through it.

is the structured process of guiding potential customers from initial awareness of a product to the final purchase decision. It typically includes stages such as:

- Prospecting

- Conversations

- Closing

- Revenue/Promised Land

3. Early-Stage Customers Along the Diffusion of Innovation Curve

When you're an early-stage tech company full of risk, who are your customers along the Diffusion of Innovation curve and what are the implications for your sales efforts/approach?

Early-stage tech companies should target innovators and early adopters (the first two segments of the Diffusion of Innovation curve). These groups:

- Are risk-tolerant and eager to try new solutions.

- Value innovation over polish.

- Provide candid feedback to refine the product.

Implications for Sales: - Personalized outreach: Build relationships through direct communication (e.g., 1:1 emails, calls).

- Focus on pain points: Highlight how the product solves specific, urgent problems.

- Iterative selling: Use feedback to adapt the product and messaging.

Avoid broad marketing campaigns, as the early majority and later segments require proven solutions and social proof.

4. Effectively Reaching Prospective Customers

Early-stage startups should:

- Leverage founders’ networks: Tap into personal and professional connections for warm introductions.

- Cold outreach: Use personalized emails/LinkedIn messages targeting specific roles (e.g., CTOs for technical products).

- Attend niche events: Participate in industry meetups, conferences, or webinars where early adopters gather.

- Create urgency: Offer limited-time pilots or discounts to incentivize trial.

- Leverage content: Publish blogs, case studies, or demos that address core customer challenges.

5. Key Characteristic of a Successful Sales Conversation

The most critical characteristic is active listening. Successful sales conversations focus on:

- Understanding the prospect’s pain points, goals, and objections.

- Tailoring the pitch to address specific needs.

- Building trust by demonstrating empathy and expertise.

- Asking open-ended questions to uncover deeper insights (e.g., “What’s your biggest challenge with [problem]?”).

6. Evolving the Sales Approach to Scale to $100M

The sales strategy must adapt based on deal size (Annual Contract Value, ACV):

- Small Deals (Low ACV, e.g., <$10k):

- Self-service: Scale through inbound marketing, freemium models, or automated onboarding.

- Inside sales: Use lower-cost reps to handle high-volume transactions.

- Medium Deals (10k–10*k*–100k):

- Product-led growth: Combine self-service with light-touch account management.

- Channel partnerships: Partner with resellers or integrators to expand reach.

- Large Deals (>$100k):

- Enterprise sales: Deploy dedicated account executives and solutions engineers.

- Long cycles: Focus on building relationships with multiple stakeholders (e.g., executives, end-users).

- Customization: Offer tailored solutions and SLAs to justify premium pricing.

Example: Clever (Tyler’s company) started with founder-led sales to schools (low ACV), then scaled through partnerships and product-led growth to reach millions of users.

Key Insight: Early-stage sales require founders to wear multiple hats, prioritize learning, and iterate rapidly. As the company grows, processes and teams must formalize to match the complexity and scale of deals.

Palm

1. Applying "Innovation: A Customer-Driven Approach" to Product Design

The Innovation Funnel and Kano Method principles suggest Hawkins should:

- Deeply Engage Stakeholders:

- Interview GRiDPad users (corporate clients) to identify unmet needs for a personal device (e.g., portability, ease of use, specific features like calendar integration).

- Involve internal stakeholders (engineers, marketers) and external partners (Geoworks for the OS) early to align on technical and market requirements.

- Prioritize Features Using the Kano Model:

- Must-Haves: Reliable handwriting recognition (PalmPrint), basic organizational tools (calendar, address book).

- Linear Satisfiers: Battery life, screen clarity.

- Delighters: Syncing capabilities with PCs, customizable interfaces.

- Iterate with Prototypes:

- Build low-fidelity prototypes (e.g., mockups) to test usability with early adopters. Refine based on feedback, such as simplifying input methods or improving ergonomics.

- Leverage Modular Architecture:

- Design the product with modular components (e.g., separable hardware/software) to allow upgrades (e.g., memory expansion) and reduce dependency on single suppliers.

Key Takeaway: Avoid over-engineering. Focus on solving core customer pain points (e.g., replacing paper organizers) rather than competing with full-featured PCs.

2. Applying the "Sales Learning Curve" to Sales Strategy

Per the Sales Learning Curve, Hawkins should:

- Initiation Phase:

- Founder-Led Sales: Hawkins and a small team (2–3 reps) should personally target innovators (tech enthusiasts, GRiDPad super-users) and early adopters (e.g., executives in industries like healthcare or logistics).

- Beta Testing as Sales Tool: Offer pilot programs to early customers (e.g., universities, small businesses) in exchange for feedback. Use insights to refine the product and sales pitch.

- Avoid Premature Scaling: Delay hiring a large sales force until the product and sales process are validated.

- Transition Phase:

- Develop Repeatable Sales Model: Once early adopters validate the product (e.g., positive ROI from pilots), hire "enlightened reps" to systematize outreach (e.g., telesales for education sector).

- Partner Strategically: Collaborate with Tandy/RadioShack for distribution, but negotiate terms to retain flexibility (e.g., non-exclusive agreements).

- Execution Phase:

- Scale with Standardization: After achieving "traction" (e.g., consistent sales yield), expand sales teams and marketing campaigns (e.g., TV ads targeting mainstream users).

Key Risks to Mitigate:

- Premature Marketing: Avoid broad campaigns until product reliability is proven (e.g., GRiDPad’s success was partly due to iterative improvements post-launch).

- Overdependency on Tandy: Secure cross-licensing for GRiD’s "C language" enhancements but diversify partnerships (e.g., explore Sony or HP for hardware manufacturing).

Integration of Both Frameworks

- Customer Feedback Drives Sales Strategy: Early adopters’ input informs both product refinements (Innovation Funnel) and sales tactics (e.g., targeting Linux evangelists first, as Scalix did).

- Align Resources with Learning Phases: Use limited cash reserves to fund iterative development and small-scale pilots rather than overhiring.

Outcome: By combining customer-centric design with phased sales scaling, Palm can avoid the fate of Momenta (which burned $55M prematurely) and replicate Clever’s success in transitioning from founder-led sales to scalable growth.

Final Note: Hawkins’ ability to balance IP negotiations (with Tandy) and customer-driven agility will determine whether Palm becomes the "iPhone of the 90s" or a cautionary tale.

Stakeholders objectives

Which objectives

- are more important (to )

Negotiation

- How do we turn innovation into products, and products into ventures?

Chart, is not to calc,

They teach sales management, but not teach sales.

Rogers Diffusion of Innovation